A tariff war between the United States and China is playing a big part in the health and well-being of the U.S. cotton market.

Last July 6, China imposed a 25 percent tariff on all imported U.S. cotton, selling at about 72 cents a pound for upland cotton, amounting to an approximately $525-per-ton tax.

Cotton-industry observers said the tariffs have been extremely destructive to the U.S. cotton market, whose biggest export country after Vietnam is China. In the 2017/2018 marketing year, the United States shipped 2.6 million bales of cotton to China, valued at nearly $1 billion.

“China has a very healthy consumption of cotton. They are the largest consumers in the world,” said Karin Malmstrom, director of China and northeast Asia for Cotton Council International, which was presenting a cotton seminar Jan. 14–17 at Hong Kong Fashion Week. “They grow 24 million bales a year, but they have a gap.”

The 25 percent tariff on cotton is part of the $50 billion in tariffs China levied on various U.S. commodities including soy beans, autos and seafood after the Trump administration imposed a 25 percent tariff on $50 billion of Chinese goods including cars, motorcycles and various machine parts.

Then, in September, the U.S. tacked on a 10 percent tariff on $200 billion worth of Chinese products, which included fabric, handbags and electronics.

Cotton is a big moneymaking product for the United States, which exports almost all its domestic crop and is the largest cotton exporter in the world. Its biggest market area is Latin America, where cotton gets shipped to Central America to be spun into yarn and then made into fabric for clothes that come back to the United States. The country’s second-largest cotton export area is northeast Asia.

With tariffs making U.S. cotton cost more, Chinese cotton importers are looking to other countries—including Brazil, Australia and India—to fill their needs at a lower cost.

“Brazil is the country that everyone is expecting China to buy from,” said Jon Devine, senior economist at Cotton Inc., the research and marketing company representing U.S. upland-cotton growers. Brazil is preferred because, like the United States, it uses machines rather than hand labor to harvest its cotton, resulting in less debris in the picked cotton.

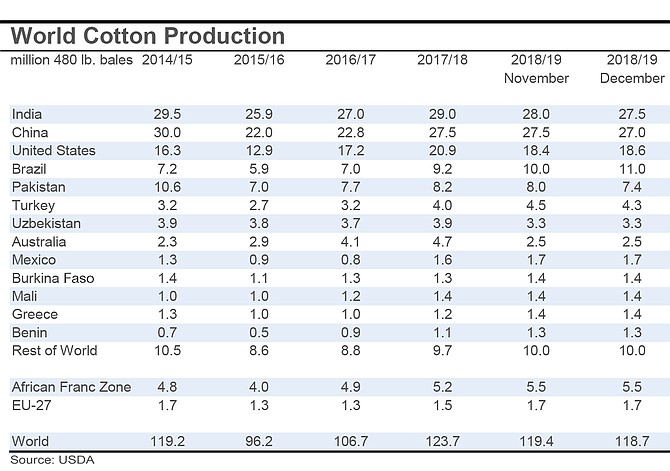

Once manufacturers get used to importing cotton from another country, it is hard to get them to switch back. Knowing this, Brazil is trying to gain more market share in China by upping its cotton production by 19 percent. For the 2018/2019 crop season, which runs from August 2018 to July 2019, the country is expected to harvest 11 million bales of cotton.

Meanwhile, three years ago, Vietnam became the top importer of U.S. cotton. “Over the past few years, some of China’s mills found it prohibitive to get U.S. cotton because of quotas,” Malmstrom said. “So they went to Vietnam to set up spinning mills. Half the cotton used in Vietnam is from the United States. Some of our largest customers in Vietnam are Chinese companies that shifted their mills to produce yarn in Vietnam and then they ship it back to China.”

There was a glimmer of hope about cotton tariffs at the beginning of the year when talks took place between the United States and China during the week of Jan. 7. But so far there have been no immediate tariff reductions or a hint that things will change.

The tariff problem comes at a bad time because China will probably have to import more cotton this year than in previous years. China’s cotton inventory last year was less than 6.5 million tons, which is half the reserve it had in 2014.

That’s because, in 2011, China started hoarding cotton for its farmers to guarantee them premium prices at a time when cotton prices were peaking at about $2.27 a pound, the highest since the U.S. Civil War. But in 2015 China started selling down its reserves to get rid of its deteriorating cotton sitting in warehouses.

Also, the Chinese government is forecasting that domestic cotton output this year will fall 5.8 percent.

U.S. cotton experts had expected China to start up its U.S. cotton imports this year because its reserve will not be enough to handle its production needs. “China has a production deficit in cotton,” Devine said. “That deficit is around 15 million bales. Recent imports have been about 7 million bales. They need to increase their imports dramatically, but no one knows when that is going to happen.”